Deciding what to do with your property is one of the biggest financial choices you’ll make. Whether you’ve inherited a home, are moving into a new one, or simply want to make the most of your investment, the question often comes down to this: should I sell, or should I lease?

In today’s WA market, this decision is especially important. Perth is currently experiencing the lowest levels of property listings in decades while demand from both buyers and tenants remains exceptionally strong. That means both selling and leasing can deliver excellent outcomes — but in very different ways.

What the Market is Showing Us

Over the past five years, Perth has materially outperformed most capitals. Between 2020 and 2025, we saw a strong upswing in property values, with multiple trackers noting double-digit annual gains through 2023–2025.

In fact:

- Perth’s median house price reached $757,750 in Feb 2025 (REIWA).

- By April 2025, the Greater Perth median was – $779,000 (PropTrack).

- WA Treasury data puts the 12-month median to May 2025 at – $780,000.

This growth has been underpinned by record-low rental vacancies, a population surge (WA leading the nation with 2.4–3% y/y growth), and restricted housing supply.

Looking forward, most analysts expect Perth to continue growing, though at a more moderate pace:

Base case: median values rising 4% in 2026, cooling to 2.5% p.a. by 2030 – $911k by 2030.

High case: if migration stays high and construction bottlenecks persist – $967k by 2030.

Low case: slower demand and higher-for-longer interest rates – $803k by 2030.

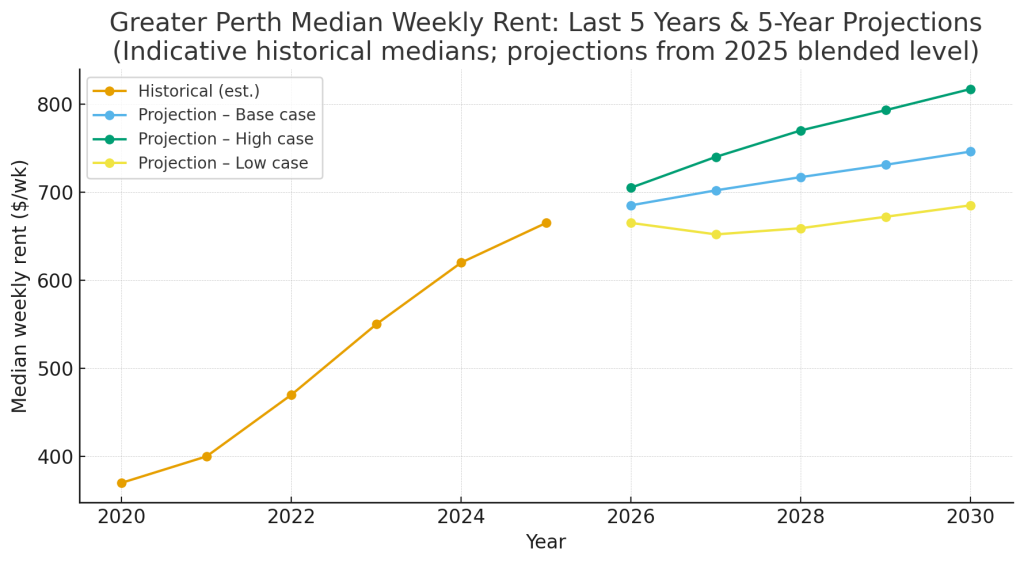

Leasing in Perth

Rental conditions have been equally remarkable. Weekly rents surged from 2021 to 2024, with houses and units hitting fresh highs into 2025. As of mid-2025:

- Houses average $680/week; units $650/week (REIWA/Yard Property).

- Vacancy has lifted slightly to 2.2% (Aug 2025) but remains well below long-term averages.

- Projections suggest rents will continue to grow, albeit at a slower pace:

Base case: $685 in 2026 – $746 by 2030.

High case: $705 in 2026 – $817 by 2030.

Low case: a flatter path, $685 by 2030.

LEASING Pros

• Ongoing income: strong weekly rents delivering reliable cash flow.

• Capital growth + yield: WA’s “double benefit” of solid yields + price growth.

• Low turnover: tenants holding leases longer in a tight market.

• Tax deductions: interest, management fees, insurance, and maintenance claims.

• Passive income: Property investment is a tried-and-true method of passive investment and wealth creation.

• The next property: The leased property will work for you for your next property or maybe your next holiday.

• Capital: if you need a substantial amount of capital and that is why you want to sell review the lending option so you can access the capital and have the rent assist in the loan repayment.

LEASING Cons

• Responsibilities: maintenance, compliance, and insurance obligations.

• Vacancy or arrears risk: while low now, always a possibility. Insurance and a good property manager can manage most situations.

• Market cycles: rents can fluctuate with supply and demand. The reasonable outlook is for a further two years of rental growth which could easily stretch to five years.

Selling in Perth

With stock at historic lows and demand strong, sellers continue to benefit from premium buyer competition.

SELLING Pros

• Access equity now: free up capital for your next move.

• No landlord duties: no tenants, maintenance, or compliance to worry about.

• Strong buyer demand: fewer homes = more competition and premium results.

SELLING Cons

• You exit the market: missing long-term capital growth projections, however, if the property is an investment you may need to pay capital gains.

• Transaction costs: agent fees, marketing, settlement, and if you enter the market again you will have to pay a substantial stamp duty again..

• Timing risk: if the market rises further, selling early means missing gains.

So, Which Is Right for You?

If you’re looking to access equity and move on quickly, Perth’s tight stock levels and buyer competition make this an attractive time to sell.

If your goal is long-term wealth creation, today’s landlord-friendly rental market offers strong weekly returns, low vacancy, and high tenant demand – making leasing equally appealing.

Ultimately, the right decision depends on your financial goals, personal circumstances, and appetite for risk.

How Orana Can Help

At Orana, we guide you through every step, whether selling or leasing. Our award-winning property managers and market experts combine smart technology with personalised service, ensuring you get the best outcome for your property.

📞 Call us today on 1300 509 554 to explore your options.

Orana Property Group

Open the Door to a Better Experience